avalara tax codes mapping

Verify Avalara calculated Tax Amount. Mapping tax codes to products using Webgility is optional.

Steps In AvaTax go to Settings What You Sell.

. Item means i a Universal Product Code UPC or ii other unique product. Tax code mapping group. The combined tax rate is the total sales tax of the jurisdiction for the address you submitted.

Marketplace facilitator tax laws. Choose Build a taxability matrix. AvaTax tax code mapping - Item codeSKU.

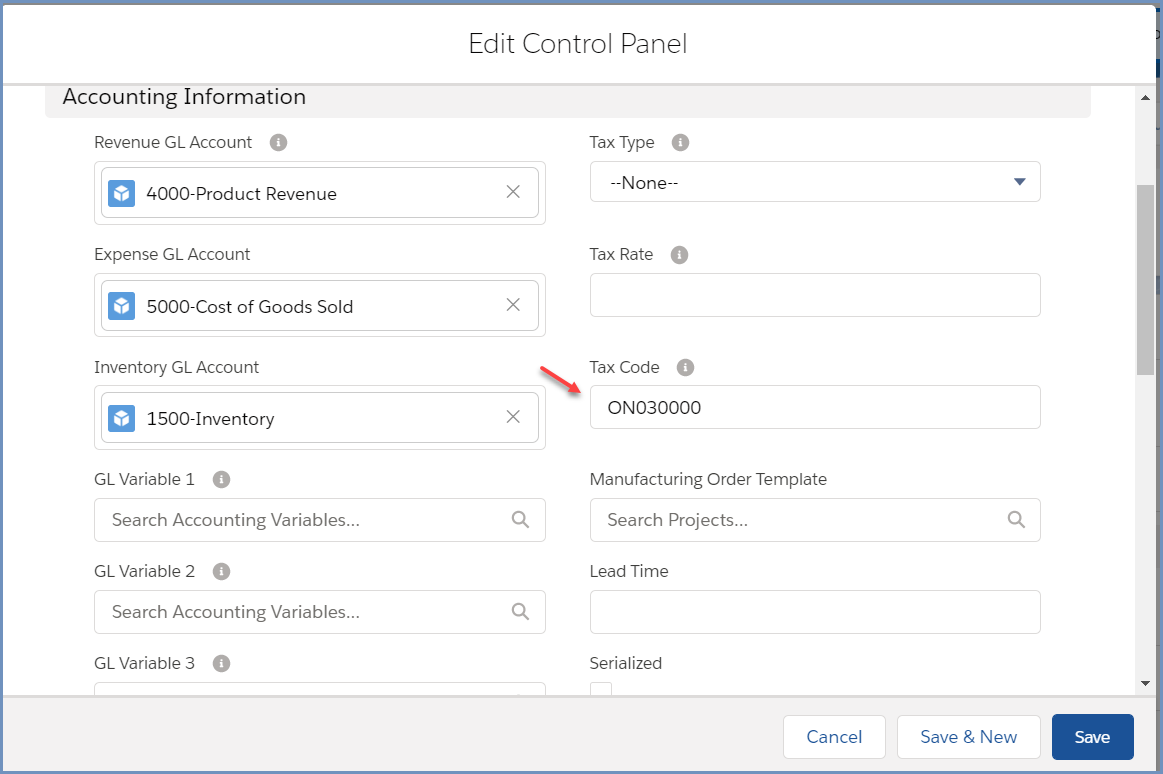

Sales and use tax determination and exemption certificate management. Items in AvaTax should have both a tariff code and a tax code to ensure that imported and exported products are taxed properly when shipped between countries. Note while this is one option for mapping your items to product tax codes there are several reasons to consider the alternative approach outlined later in this article.

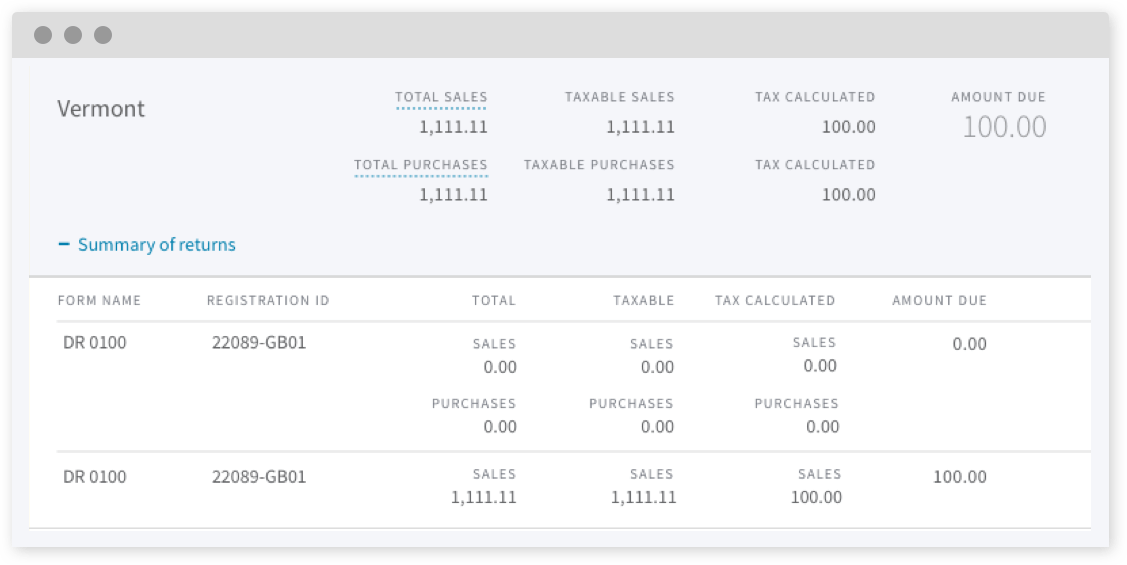

Returns preparation filing and remittance. Sales and use tax determination and exemption certificate management. Two letters to start and six numbers at the end.

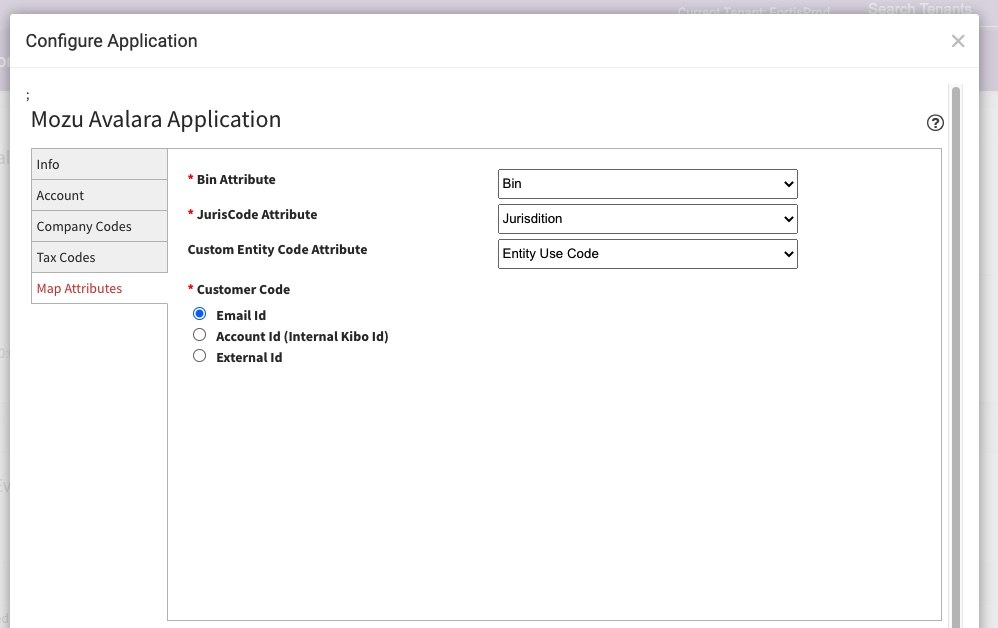

You can either start typing and select from the list of available tax codes or paste the appropriate tax code. You can copy and paste a code you find here into the Tax Codes field in. Some customers prefer to go further - to actually create a product catalog and use AvaTaxs ItemCode feature to classify their products and link them.

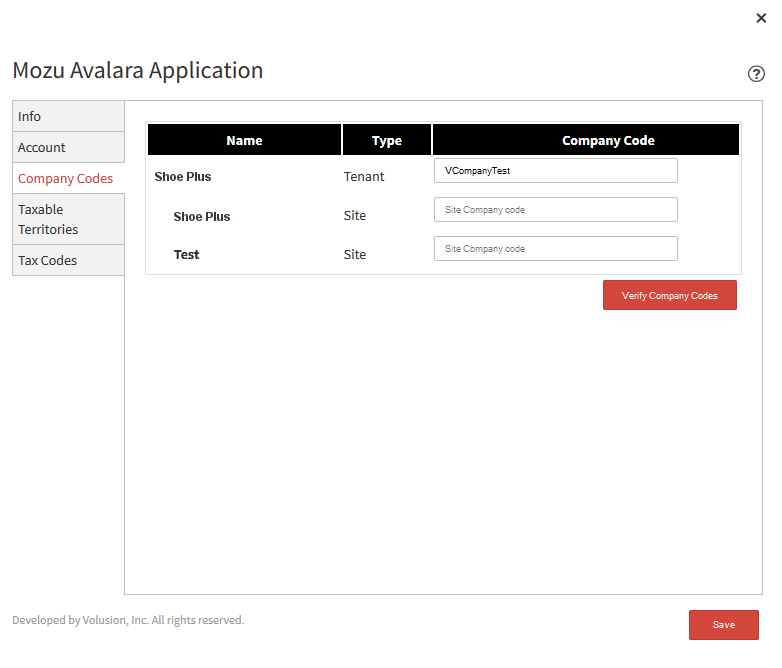

Communications Enterprise Support Services. Sales and use tax determination and exemption certificate management. The most common place to map an item to a tax code is the place where you maintain your master inventory list.

On the What You Sell page select the checkboxes next to the items you want to map to the same Avalara tax code and then. The first letter indicates the tax code type P for products D for digital Fr. Customer Data has the meaning given in the Terms but does not include the Service Output.

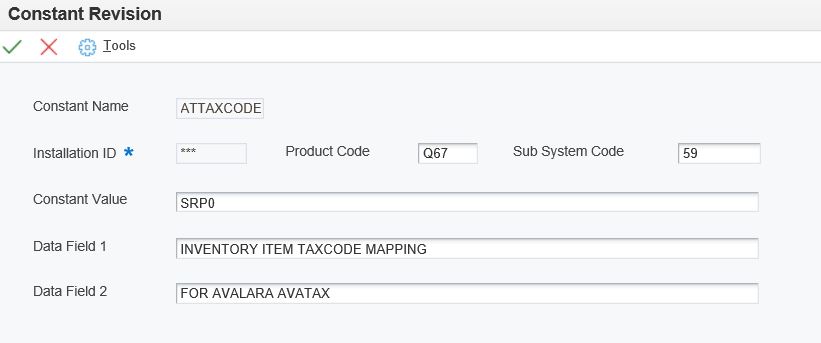

Returns preparation filing and remittance. 53 - Mapping Items to TaxCodes. Server audit clarity and installation.

Most Avalara tax codes are made up of eight characters. Common Transaction and Service type mapping scenarios in AvaTax for Communications. Determine where you want to map items to Avalara tax codes.

AvaTax for Communications AFC uses a system of numbers to represent the Transaction Types and Service Types for the service you wish to tax. Returns preparation filing and remittance. Tax code mapping should be done within the active company in the Avalara AvaTax account as tax code mapping in.

Marketplace facilitator tax laws. Add up to 20 tax codes. Marketplace facilitator tax laws.

You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. The jurisdiction breakdown shows the different tax rates that make up the combined rate.

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

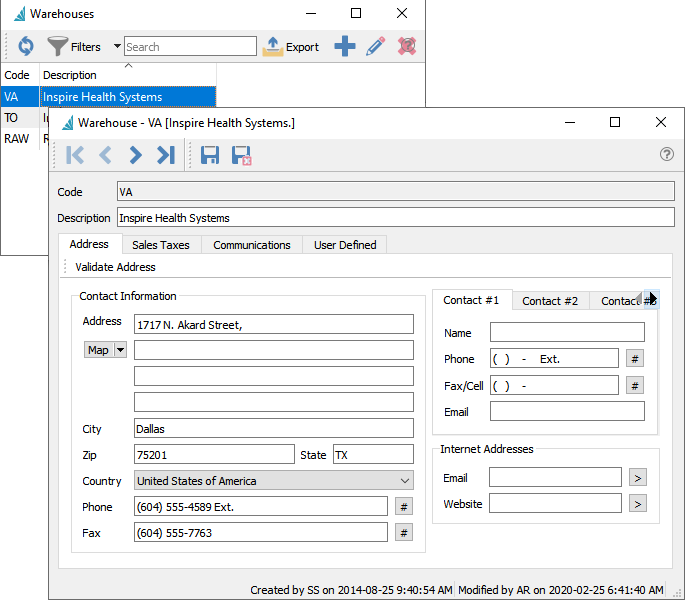

Avalara Sales Tax Spire User Manual 3 5

Zip Codes The Wrong Tool For The Job

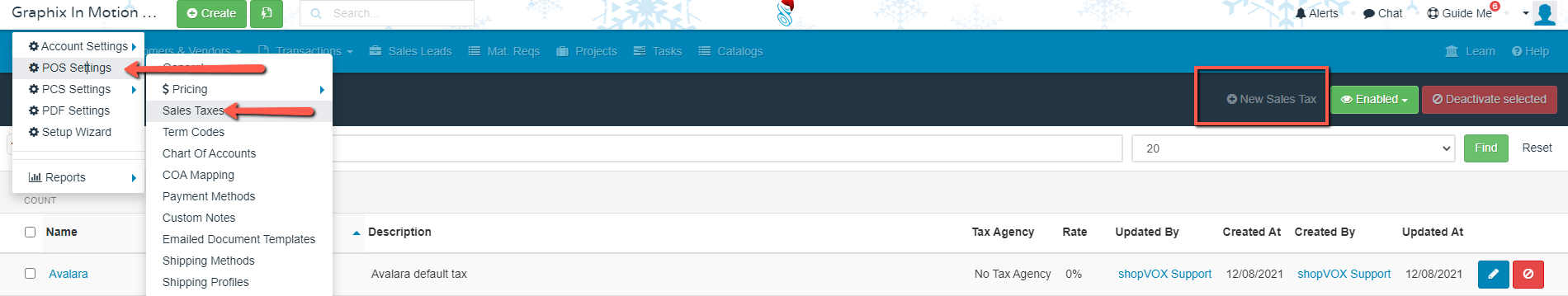

Avalara Avatax Sales Tax Setup Guide Shopvox Help Center

Understand Sales Tax Holidays In Avatax Avalara Help Center

Avatax Sales Tax Calculation Software Avalara

Automate Freight Tax Erp 10 Epicor User Help Forum

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Avalara A Compounding Growth Story Nyse Avlr Seeking Alpha

Sync Avalara Taxcode To Shopify Tax Code Field Celigo Help Center

Woocommerce Avatax Woocommerce

Avatax For Intacct Implementation Checklist Overview Winifer Cheng Winifer Ppt Download

Avatax Exemption Codes And Certificates Certcapture Suiteretail Knowledge Base

Avalara Salestax Free Sales Tax Calculator Rate Lookups Map Sales Tax Calculator